Last updated on 2025-11-04

1. What are Singapore Savings Bonds?

2. How Does Singapore Savings Bonds Work?

3. What is the Return on Singapore Savings Bonds this Month?

4. Singapore Savings Bonds Yields History for Past Year

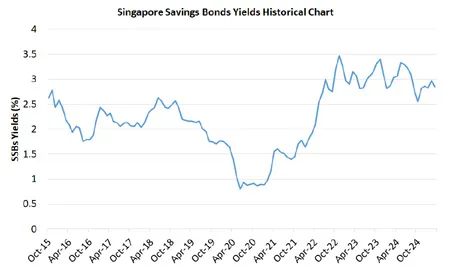

5. Singapore Savings Bonds Yields Historical Chart

6. Is Singapore Savings Bonds Safe?

7. Singapore Savings Bonds Statistics

8. How do I Invest in Singapore Savings Bonds?

9. Is Singapore Savings Bonds a Good Investment?

Singapore Savings Bonds (SSBs) are a type of specially-issued Singapore Government Securities (SGSs) that is meant for Singaporeans who want to increase their savings but at a risk-free way. This offer is exclusively available only for individual Singapore retail investors (any nationality) and aims to complement the other options available to grow their eggnest.

A Singapore Savings Bondholder (SSB) can expect to receive a yield that matches the Singapore Government Securities (SGS) yield of the same holding period at the time the SSB is issued. The yield is higher for longer holding periods and is reflected through SSB through a step-up component. Each issue of SSB will have their own fixed yield and will not change after you have purchased them. A quick check with the Monetary of Singapore (MAS) website indicates that the historical 10-year SGS yield is between 0.80% to 3.63%. 10-year SSB yields have ranged from 0.80% to 3.47% since its introduction in 2015. Investors can check the yields of their SSB portfolio by logging into MAS SSB's page.

| Year | 1 | 2 | 3 | 4 | 5 |

| Interest | 1.35% | 1.56% | 1.66% | 1.74% | 1.83% |

| Average | 1.35% | 1.45% | 1.52% | 1.58% | 1.62% |

| Year | 6 | 7 | 8 | 9 | 10 |

| Interest | 1.93% | 2.01% | 2.10% | 2.19% | 2.29% |

| Average | 1.67% | 1.72% | 1.76% | 1.81% | 1.85% |

The average yield for the latest issue of Singapore Savings Bonds is 1.35% for a holding period of 1 year and 1.85% for a holding period of 10 years as seen on Singapore Savings Bonds website.

| Dec 24 | Jan 25 | Feb 25 | Mar 25 | Apr 25 | May 25 |

| 2.86% | 2.82% | 2.97% | 2.85% | 2.69% | 2.56% |

| Jun 25 | Jul 25 | Aug 25 | Sep 25 | Oct 25 | Nov 25 |

| 2.49% | 2.29% | 2.11% | 1.93% | 1.83% | 1.85% |

Singapore Savings Bonds is a risk-free investment. Investors can sell their SSBs at cost to the government anytime and receive their money back within a month without any penalty. This feature allows investors to sell their lower yielding SSBs bought previously to buy higher yielding SSBs when market interest rate rises. Hence SSBs have effectively no interest rate risk. In addition SSBs are principal-guaranteed by the Singapore Government which makes it even safer than fixed deposits which is only insured for a sum of up to $75,000 (see Singapore Savings Bonds vs Fixed Deposits for a comparison).

- Issued monthly starting from October 2015

- Maximum 10 years holding period

- Minimum $500 purchase

- Fixed price of $500 with additional purchases or redemption in multiples of $500

- Maximum holding of $200,000 worth of SSBs at any point of time

- Can be bought using SRS or cash or a combination of both

- Non-transferable or selling to other individuals

- Yields and returns for each monthly monthly issue to be published in newspapers as well as on Singapore Savings Bonds website

- Interest paid every 6 months after purchase of SSBs on the 1st business day

- Applications open on the 1st and closes on the 4th last business day of every month

- Results of applications to be released on the 3rd last business day of every month

- Application through local banks ATMs (cash applications) or online internet banking (cash or SRS applications) from 7 a.m. to 9 p.m. Monday to Saturday excluding public holidays

- $2 transaction fee for application

- Investors are required to have an individual CDP Securities account (SGX website on opening CDP account)

- Investors are required to have a Direct Crediting Service to link your CDP Securities account to your bank account so that interest can be credited straight to your bank account (SGX website on Direct Crediting Service)

SSBs are designed in such a way such as to allow the average retail investor to have access to SGS bonds minus the risk of capital loss and is a good investment for the risk averse. It is basically a gift from the Singapore government and its an alternative investment product as compared to higher risk products. The step-up component and the risk-free nature of SSBs is a huge draw. The yields of SSBs are currently higher than most fixed deposit rates although both rates have dipped significantly from the peaks seen in 2023. Shrewd investors can take advantage of current rates and maintain a balanced portfolio of SSBs and fixed deposits or Treasuries to maximise long term returns.