Last updated on 2026-01-23

1. What is Money Lobang's National Average Fixed Deposit Rates?

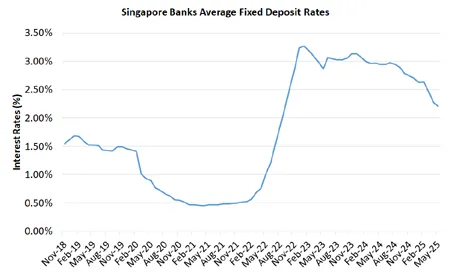

2. Singapore Average Fixed Deposit Interest Rates History Chart

3. Historical Average Fixed Deposit Interest Rates for Past Year

4. Will Fixed Deposit Rates Decrease in 2026?

5. How is Average Fixed Deposit Rates Calculated?

6. MAS Fixed Deposit Rates Data

7. How Much of your Money in the Bank is Insured?

8. What is the Tenure of Deposit in Average Fixed Deposit Rates?

Money Lobang's National Average Fixed Deposit Rates is derived from a monthly national survey of fixed deposit rates at the largest consumer banks and finance companies in Singapore. The survey is conducted by collecting data for the highest fixed deposit rates for up to $100,000 deposits from each bank or finance company with 3 to 18 months tenure. The average rate collected from the data is presented to depositors as National Average Fixed Deposit Rates to compare their potential returns from various fixed deposits at any bank or finance companies. The current Money Lobang's National Average Fixed Deposit Rates for February 2026 is 1.20% p.a. Refer to Singapore Fixed Deposits Promotional Rates for the current most up-to-date fixed deposit rates for each individual bank or finance company.

| Mar 25 | Apr 25 | May 25 | Jun 25 | Jul 25 | Aug 25 |

| 2.47% | 2.28% | 2.12% | 1.94% | 1.69% | 1.44% |

| Sep 25 | Oct 25 | Nov 25 | Dec 25 | Jan 25 | Feb 26 |

| 1.27% | 1.21% | 1.22% | 1.20% | 1.20% | 1.20% |

After tumbling for the whole of 2025, fixed deposit rates have stabalised somewhat in recent months. Depositors should take advantage of deposit alternatives such as Singapore Savings Bonds which offer higher returns as interest rates are still expected to drop further.

Our monthly survey is conducted in the first week of each month with the highest fixed deposit rate with a tenure of between 3 to 18 months with a maximum deposit of $100,000 collected as data. We assume the depositor is depositing fresh funds and doesn't have any existing relationship with the bank or finance company. Participating banks and finance companies where our data is collected from in Singapore include DBS or POSB, OCBC, UOB, CIMB, Maybank, RHB, HSBC, Standard Chartered Bank, Citibank, Bank of China, ICBC, State Bank of India, ICICI, Bank of East Asia, Singapura Finance, Singapore Investments & Finance, HL Bank and Hong Leong Finance.

Money Lobang's National Average Fixed Deposit Rates uses data that include both fixed deposit board rates and fixed deposit promotional rates from 3 to 18 months tenure and is a more accurate portrayal of average fixed deposit rates as compared to Monetary Authority of Singapore (MAS) average fixed deposit rates. This is because MAS only include data for 3 or 6 or 12 months fixed deposit rates which usually will not coincide with the tenure for the fixed deposit promotional rates at any point of time. Hence, MAS average fixed deposit rates tend to be lower than Money Lobang's National Average Fixed Deposit Rates which is able to reflect fixed deposit promotional rates better. For example, MAS monthly average fixed deposit rates (12 months) for 2021 is 0.24% p.a. but Money Lobang's National Average Fixed Deposit Rates (3 to 18 months) for 2021 is much higher at 0.48% p.a.

Singapore Deposit Insurance Corporation (linked to the Singapore government) insures all deposits in any individual bank or finance company operating in Singapore for a sum of up to $100,000 and hence $100,000 is the risk-free sum for all Singapore depositors. Hence, $100,000 is also the deposit amount we used in the calculation for average fixed deposit rates. The figure was raised recently to $100,000 from 1 April 2024.

We collect fixed deposit rates data of various banks and finance companies between 3 to 18 months tenure. This is due to the fact that depositors are usually only interested in the highest fixed deposit rates in between 3 to 18 months with shorter tenures having too low returns and longer tenures requiring too long commitment. Banks and finance companies are also aware of this and usually reserved their highest fixed deposit promotional rates for 3 to 18 months tenure.

However, different banks or finance companies prefer to use different tenures for their highest fixed deposit promotional rates with some of them preferring odd tenures that are neither 3 or 6 or 12 months tenure (MAS data collection points). Through collecting data which consists of the highest fixed deposit rates for each bank or finance company from 3 to 18 months tenure, we can get a more accurate portrayal of the fixed deposit interest rate environment as no data from odd months will be left out.