Last updated on 2026-01-28

1. Is Inflation Good or Bad for Savings?

3. What Happens to Fixed Deposit Interest Rates in a Recession?

4. What is Average Fixed Deposit Interest Rate in Singapore?

Inflation is publicly recognised has being bad for savings. The age-old adage that interest earned from savings deposits will never beat inflation rates has been aggressively advocated by financial advisors and well-publicised in mass media.

However, if this statement is always right, then why do people even bother depositing money in banks? Everybody should just invest all their excess money in financial products and be able to live comfortably knowing that their investments will always churn out higher returns than the increase in prices of goods. In such a scenario, the law of economics will ensure that deposit rates become higher to attract the smaller supply of deposits in the market and investment returns become lower as prices of financial products increase due to the increase in demand.

Let us examine the bank deposit rates vs inflation rates in a Singapore context to understand the comparison better and whether bank deposit rates will always be lower than inflation rates.

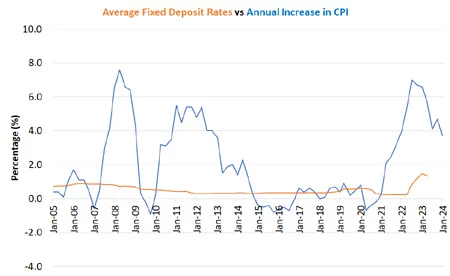

Note : We use Monthly Average Fixed Deposit Rates (12 months tenure) data from Monetary Authority of Singapore (MAS) as a reference rate for savings rates and Percentage Change in Consumer Price Index (CPI) over Corresponding Period in Previous Year, Monthly data from Singstat as a reference for inflation rates in the chart above

As evident from the chart, average fixed deposit rates are fairly constant at below 1% p.a. over the past 15 years. Comparatively, the percentage change in CPI has been quite volatile going through periods of deflation (negative percentage change) during economic slowdowns or recessions and soaring above 4% p.a. in other years. We can conclude comfortably that bank deposit rates can beat inflation rates but usually only during periods where the performance of the economy is lacklustre or in a recession. Not so coincidentally, financial markets also tend to not do well when the economy does not do well, decreasing the appeal of financial products. Looks like we should always save our money during rainy days so as to be able to invest and earn when times are good.

The Singstat average annual increase in CPI (inflation) since year 2000 is 1.85% p.a. which is more than double MAS monthly average fixed deposit rates (12 months) of 0.73% p.a. indicating that the annual inflation rate is usually much higher than deposit rates. However, if one were to use Money Lobang's National Average Fixed Deposit Rates which take into account of fixed deposit promotional rates better than fixed deposit data from Singstat, the gap will be narrowed significantly.

Money Lobang's National Average Fixed Deposit Rates uses data that include both fixed deposit board rates and fixed deposit promotional rates from 3 to 18 months tenure and is a more accurate portrayal of average fixed deposit rates as compared to MAS average fixed deposit rates which we used for the above chart. Both average rates are highly correlated and move in the same direction but Money Lobang's National Average Fixed Deposit Rates tend to be higher as it is able to reflect fixed deposit promotional rates better. For example, MAS monthly average fixed deposit rates (12 months) for 2022 is 0.75% p.a. but Money Lobang's National Average Fixed Deposit Rates (3 to 18 months) for 2022 is 1.58% p.a. which is somewhat closer to Singstat annual increase in CPI (inflation) for year 2022 of 6.1% p.a.