Last updated on 2026-02-09

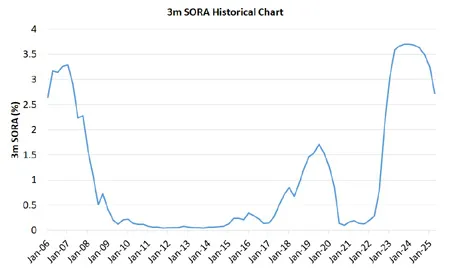

3. 3 Month SORA Rate History Chart

4. 3 Month SORA Historical Rate for Past Year

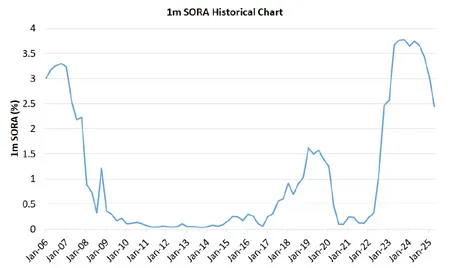

5. 1 Month SORA Rate History Chart

6. 1 Month SORA Historical Rate for Past Year

7. SORA Interest Rate Forecast 2026

SORA is the acronym for Singapore Overnight Rate Average and is the average interest rate that Singapore banks charge to lend to each other overnight. SORA is based on recorded past transactions and is more predictable and less volatile compared to other reference rates and hence is regularly used as a reference rate where loans are pegged to. SORA is set daily (working days) by the Association of Banks in Singapore and is publicly available on Association of Banks in Singapore website.

The 3 Month SORA rate is currently 1.15% as compared to the 1 Month SORA rate which is 1.11% with rates accurate as of February 2026.

| Mar 25 | Apr 25 | May 25 | Jun 25 | Jul 25 | Aug 25 |

| 2.72% | 2.55% | 2.35% | 2.26% | 2.05% | 1.82% |

| Sep 25 | Oct 25 | Nov 25 | Dec 25 | Jan 26 | Feb 26 |

| 1.55% | 1.45% | 1.31% | 1.26% | 1.18% | 1.15% |

| Mar 25 | Apr 25 | May 25 | Jun 25 | Jul 25 | Aug 25 |

| 2.45% | 2.36% | 2.24% | 2.19% | 1.69% | 1.62% |

| Sep 25 | Oct 25 | Nov 25 | Dec 25 | Jan 26 | Feb 26 |

| 1.34% | 1.39% | 1.24% | 1.13% | 1.18% | 1.14% |

SORA is set to drop over the next 12 months as inflation is subdued, economic growth slows and interest rates drop. Both chart and data for 3 month and 1 month SORA indicates that SORA is on a downtrend and will continue to drop to lower levels in 2026. Borrowers should look for floating interest rate loans to take advantage of lower mortgage rates. While interest rates are unlikely to rise in the near future, it will be most prudent for borrowers to take into account of higher interest rates when taking a loan so as not to overstretch themselves.