Last updated on 2026-01-01

Decent FD rates

Foreign Bank with limited branches

Limited time promotion

Higher rates only for preferred banking clients

Sponsored Links

![]() Up to 70% off Lazada

Up to 70% off Lazada

![]() Up to $30 off Promo Codes

Up to $30 off Promo Codes

![]() Up to 70% off Shopee

Up to 70% off Shopee

![]() Up to $50 off with Promo Codes

Up to $50 off with Promo Codes

| 3 mths | 6 mths | 12 mths | |

|---|---|---|---|

| >$10k Personal Banking | 1.30% p.a. | 1.30% p.a. | 1.10% p.a. |

| >$10k Preferred Banking | 1.35% p.a. | 1.35% p.a. | 1.15% p.a. |

Receive up to 1.15% p.a. for 12 months fixed deposit

Receive up to 1.15% p.a. for 9 months fixed deposit

Receive up to 1.35% p.a. for 6 months fixed deposit

Receive up to 1.35% p.a. for 3 months fixed deposit

Minimum deposit of $10,000

Click here to go to CIMB website for more details

* Interest Rates based on highest fixed deposit rate with

maximum deposit amount of $100,000 and 3 to 18 months tenure

CIMB current highest fixed deposit rate is 1.30% p.a. for 6 months tenure with minimum deposit of $10,000.

The current highest fixed deposit rate is a CIMB fixed deposit promotional rate

The current Money Lobang National Average Fixed Deposit Rates for January 2026 is 1.20% p.a.

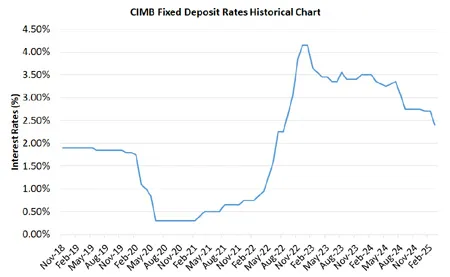

The average monthly highest fixed deposit rate for CIMB since 2018 is 1.94% p.a.

CIMB has been running a fixed deposit promotion since March 2021