Last updated on 2022-12-31

1. What Rewards can you get from Credit Cards in Singapore?

2. Value of Miles vs Value of Cashback

3. Time Needed to Earn Free Flight vs Time Needed to Earn Cashback

4. Miles as Store of Value vs Cashback as Store of Value

5. How to Earn Miles vs How to Earn Cashback

6. Hidden Costs and Hidden Benefits of Air Miles Credit Cards

7. Is it Better to get Air Miles or Cashback?

Banks reward credit card users (or rather entice them) with air miles or cash back in return for spending on their cards. Advocates of Mileage Credit Cards tend to shun the other camp (and likewise for Cash Back Credit Cards users). There will never be a clear-cut winner on which type of credit cards are better but understanding the following factors will give you a clearer picture on where you stand.

The valuation of a mile is something that differs greatly among credit card users (see Value of a KrisFlyer Mile for Singapore context). It can have zero value for someone who doesn't like to fly or who will never accumulate enough miles to fly to anywhere but it can have a value as high as 5.10 cents if you are an aspirational flyer that seeks to fly First Class and enjoy the cream of the crop of commercial airlines. We prefer to be conservative and assume a value of around 1.12 cents for a KrisFlyer mile as it is the average implied value of a mile if one were to redeem SIA Economy Class flights to all available destinations.

With mileage credit cards offering as high as 4 air miles per dollar on everyday spend (see Best Credit Cards for Air Miles), it can be translated to as high as 20% rebate (4 * 0.0510 = 0.204) for your everyday spend if you were to redeem your miles for First Class air tickets. The average spender who will never spend enough to redeem First Class air tickets can still achieve a respectable base scenario of 4.48% rebate (4 * 0.112 = 0.0448) if he were to redeem his miles for Economy Class Tickets although he might take a year or more to accumulate the required miles according to our calculations (see How Much to Spend on Credit Cards for Free Flights).

On the other hand, the valuation of cash back is simply a hard solid number that is easy to understand and one can achieve up to 10% rebate if you use the right cash back credit cards although a more realistic number is at best 5% rebate for everyday spend (see Best Credit Cards for Cash Back).

Our Take : Mileage Credit Cards win this one here as there is a higher potential rebate as compared to cash back credit cards. Notice that 4.48% rebate is a base scenario for everyday spend for mileage credit cards but 5% rebate is considered a high rebate for everyday spend for cash back credit cards? This only enforces the view that mileage credit cards provide more bang for bucks if you play your cards correctly when paying your bills.

Users who prefer almost instant gratification on their spending will prefer cash back credit cards. We say "almost instant gratification" because most cash back typically only gets credited into your credit card account after your credit card payment due date and this might take anywhere from less than a month to even a quarter of a year. Banks do this to make sure you actually pay for your bills and that you continue spending on their credit cards.

Comparatively, the time taken to accumulate Krisflyer miles for travel (equating air miles to Krisflyer miles as that is the most popular mileage redemption for Singaporeans) might differ from one person to another but one has to spend at least $4,250 on credit cards to redeem a return economy ticket to the cheapest Singapore Airlines redemption destination (see How Much to Spend on Credit Cards for Free Flights).

Simple arithmetic will tell you that one will need at least 2 to 3 months to clock that $4,250 on your mileage credit card based on an average Singaporean everyday spend. Add in the time taken for the points or miles to be transferred to your credit card account after which they will need to be transferred to your Krisflyer account and you will be looking realistically at a time frame of at least 3 to 4 months before you can start scouring SIA website for dates to redeem your nearby getaway.

However, short haul flights for nearby getaway provide poor value for your miles and if you really want to get more value out of your miles, one will need to spend at least $8,250 to redeem a return economy class ticket for destinations further than Southeast Asia (Zone 4 and above on SIA redemption chart). This also means a longer time frame of 6 to 8 months on average everyday spend.

If your aim is to maximise value out of your miles, than you will be looking to spend at least $10,500 to redeem a return business ticket to the cheapest Singapore Airlines redemption destination for business class tickets (Zone 2 on SIA redemption chart) and that will be an even longer time frame of 7 to 9 months based on average everyday spend.

Hence, mileage credit cards are really more suitable for high spenders who can shorten the time frame needed to redeem air tickets for travel. One can also time large purchases with Miles Signup Promotions to earn miles at a faster rate but unless you are only aiming for one-off redemptions, it is more advisable to go for cash back if you are a low to average spender. Average spenders can earn air tickets for travel through mileage credit cards but they will have to be realistic and understand that it probably will take a year or more to redeem a return economy ticket to any destination outside Southeast Asia.

Our Take : Cash Back Credit Cards are better for the average Joe if the time taken to receive your reward (cash back or miles) is important to you.

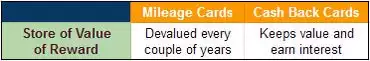

Due to the longer time taken to accumulate enough miles for a flight redemption as compared to the almost instant cash back, it results in the problem of opportunity cost for miles chasers. Air miles do not earn interest as compared to cash which stays in the bank because of a lower credit card bill due to cash back. The interest might be negligible due to the low interest rate environment but it offers some returns nonetheless. Comparatively, air miles stored in your frequent flyer account doesn't earn any returns and has a higher probability of getting devalued as airlines frequently increase the number of miles needed for redemptions (sometimes without any advance notice). In fact, Singapore Airlines last devaluation of miles was on 5 July 2022. Even if it doesn't get devalued, miles has a limited lifespan as they come with an expiry date (3 years for KrisFlyer miles with option to extend by half year for a fee). This makes it tougher for anyone to accumulate enough miles for a dream holiday.

Our Take: Cash offers a better store of value than air miles and you should pick Cash Back Credit Cards to ensure that the bird in the hand stays in the hand if you prefer hard assets that has a definite value (cash).

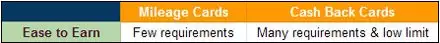

This is a major headache for cash back chasers as banks are constantly moving their goal posts (sometimes with very little advance notice) when it comes to the minimum requirements and maximum cash back cardholders can receive. Minimum requirements come in many forms and banks are actually pretty innovative when it comes to making it more difficult for people to receive cash back.

Typical requirements are minimum monthly spend, exclusion of cash back for specific categories, tiered cash back in combination with minimum spend, opening and maintaining bank accounts, minimum spend on other categories that don't earn a higher cash back, minimum monthly spend for a consecutive number of months, etc.

Banks also constantly tweak the numbers for minimum spend and maximum cash back to disadvantage cardholders and cash back credit cardholders have to be constantly on the ball to look out for such changes.

Mileage credit cardholders also face similar concerns in terms of exclusion of earning of miles for specific categories and maximum miles one can earn in a month or a year but are generally faced with much fewer requirements and higher or no maximum cap as compared to their cash back seeking counterparts.

Our Take : Mileage Credit Cards are clearly superior against cash back credit cards in this case as it is far easier to earn miles as compared to cash back with fewer minimum requirements and higher maximum cap.

Banks usually require a conversion cost or annual fee to convert your points or miles in your credit card account into miles in your frequent flyer account. Typical fees are low at $25 to $40++ (See Credit Card Air Miles Redemption Rates) but it adds on to the cost of redeeming miles and should be taken into account.

Points or miles earned per transaction on mileage credit cards are also frequently subjected to rounding which can often result in earning fewer miles than advertised headline mileage earn rates. In extreme examples such as UOB Credit Cards or OCBC Credit Cards, cardholders can only earn miles in blocks of $5 spend and that means if a cardholder where to spend $4.99 on a single transaction, he would earn 0 miles from that transaction instead of the advertised headline mileage earn rate.

Another hidden cost is the risk of orphaned miles. Orphaned miles are miles in your credit card or frequent flyer account that do not meet the minimum conversion or redemption amount and are wasted if left to expire or used to redeem less attractive rewards.

Flight redemptions are subjected to availability and it is extremely difficult to redeem tickets for highly sought-after routes like Singapore to London or New York without being put on the waiting list. Using miles for flight redemptions instead of paying with cold hard cash also means a traveller loses out on opportunity to accumulate miles from the flight. The lost is compensated with the flexibility gained to cancel the flight redemption subject to a small cancellation fee. This usually wouldn't be possible if one has to cancel a flight booked using the cheapest promotional fare.

The best reward for any credit card user depends on individual's preference. Mileage credit cards tend to suit high spenders who are willing to wait longer for their handsome rewards and with a penchant for luxury travelling (business or first class flights specifically) while cash back credit cards are more suitable for practical users who are low to average spenders that prefer almost instant gratification for their spending through trimming their credit card bills.

It is more straightforward to earn miles on mileage credit cards as compared to earning cash back on cash back credit cards which are faced with many requirements. However, the value of cash back itself is easy to understand as compared to miles which has a wide range of values depending on the type of redemption. Cash back is also a better store of value as compared to miles which might get devalued. There are also hidden costs and benefits associated with collecting and redeeming miles which credit card users need to be aware of before embarking on the mileage collection journey. To conclude, it is easier to earn miles with mileage credit cards but more difficult to keep and use the miles earned.

It is really up to an individual's preference when it boils down to cash back or miles although we have done the math involved and proved that most low to average spenders will be better off collecting cash back due to the larger amount one needs to spend for a redemption that offers good value for your miles (see How Much to Spend on Credit Cards for Free Flights). One can theoretically weigh the pros and cons of using cash back or mileage credit cards for every individual purchase so as to get the best of both worlds but it is unrealistic to do so as it would mean spending much more than you actually intend to do.

It is worth noting that it is perfectly within the rights of banks to alter the minimum requirements, maximum cap and even the cash back or mileage earn rate for both cash back and mileage credit cards at their own discretion. This can take place at little or no advance notice and cardholders are pretty much at the mercy of the banks in the game of credit cards.