Last updated on 2026-02-26

Short tenure option

Collect interest upfront

Sponsored Links

![]() Travelling often? Get protected whole-year round!

Travelling often? Get protected whole-year round!

![]() 20% off NTUC Income Yearly Travel Insurance

20% off NTUC Income Yearly Travel Insurance

![]() Thirsty for Travel?

Thirsty for Travel?

![]() 15% off Agoda Sale

15% off Agoda Sale

| 3 mths | 6 mths | 12 mths | |

|---|---|---|---|

| $10k & above | 1.30% p.a. | 1.30% p.a. | 1.30% p.a. |

Receive up to 1.30% p.a. for a 12 months fixed deposit

Receive up to 1.10% p.a. for a 9 months fixed deposit

Receive up to 1.30% p.a. for a 6 months fixed deposit

Receive up to 1.30% p.a. for a 3 months fixed deposit

Unlike a normal Fixed Deposit account where you receive your interest only at maturity, a CIMB Why Wait Fixed Deposit-i account allows you to collect your returns in the form of profit upfront

For branch application, you will also receive a CIMB StarSaver-i account with no initial deposit required or a CIMB FastSaver-i account

For online application, a CIMB FastSaver-i account will be opened to facilitate the fixed deposit placement

CIMB Why Wait Fixed Deposit-i account, CIMB StarSaver-i account and CIMB FastSaver-i account are Shariah-compliant deposit products

Enjoy the benefits of no fall-below fee and receive potential returns in the form of hibah on your CIMB StarSaver-i account

CIMB Preferred membership with a Total Relationship Balance (TRB) of S$250,000. TRB is a combination of any individual deposit and/or investment product.

Click here to go to CIMB website for more details

* Interest Rates based on highest fixed deposit rate with

maximum deposit amount of $100,000 and 3 to 18 months tenure

CIMB current highest fixed deposit rate is 1.30% p.a. for 12 months tenure with minimum deposit of $10,000.

The current highest fixed deposit rate is a CIMB fixed deposit promotional rate

The current Money Lobang National Average Fixed Deposit Rates for February 2026 is 1.20% p.a.

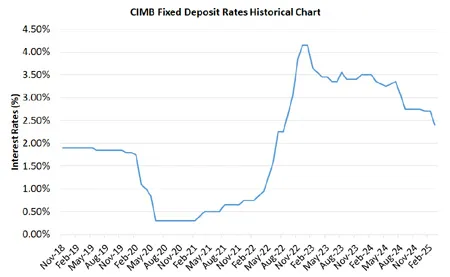

The average monthly highest fixed deposit rate for CIMB since 2018 is 1.93% p.a.

CIMB has been running a fixed deposit promotion since March 2021